Tcs Payment Due Date For March 2024

Tcs Payment Due Date For March 2024. The tcs rates are subject to change per the income tax department guidelines. According to section 234e, if a person fails to submit the tds/tcs return by the due date specified in this regard, he will be required to pay a fine of rs.200 for each day that the.

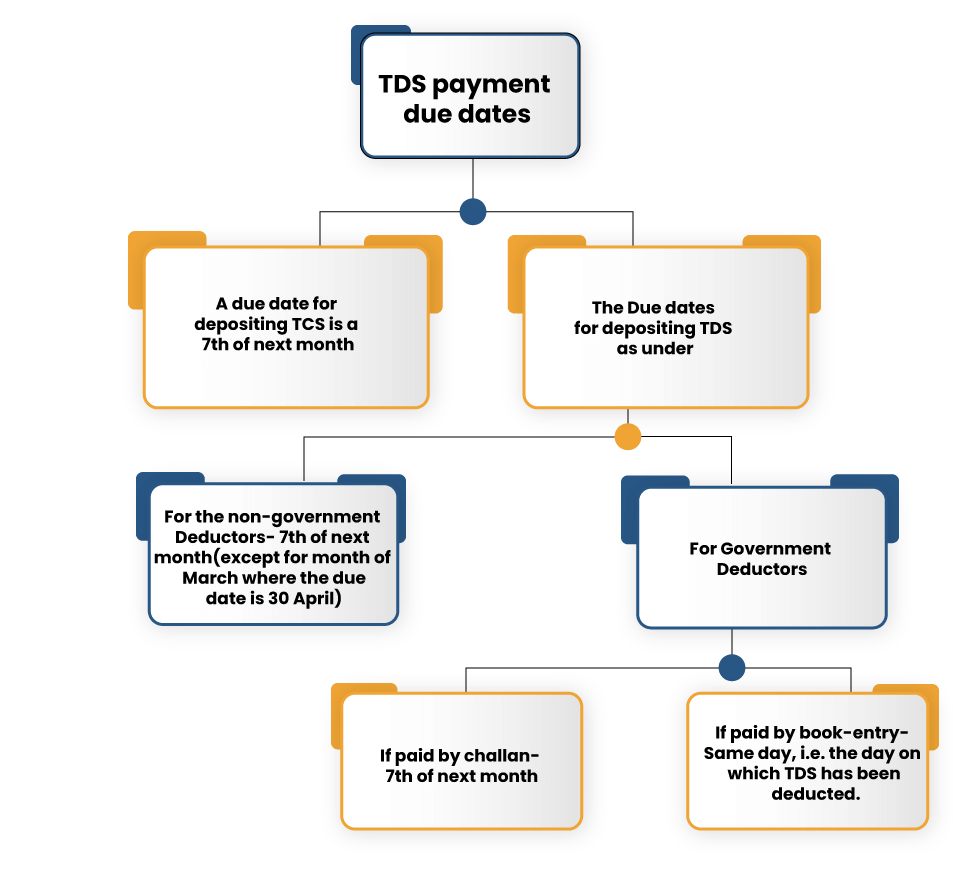

Due by 7th april 2024. In the case of the tcs, the individual accepting the payment is responsible for collecting tax from the payer and depositing it with the government.

Tcs Payment Due Date For March 2024 Images References :

Source: in.pinterest.com

Source: in.pinterest.com

Due Dates for EFiling of TDS/TCS Return AY 202223 (FY 202122) Due, Furnishing of form 24g by an office of.

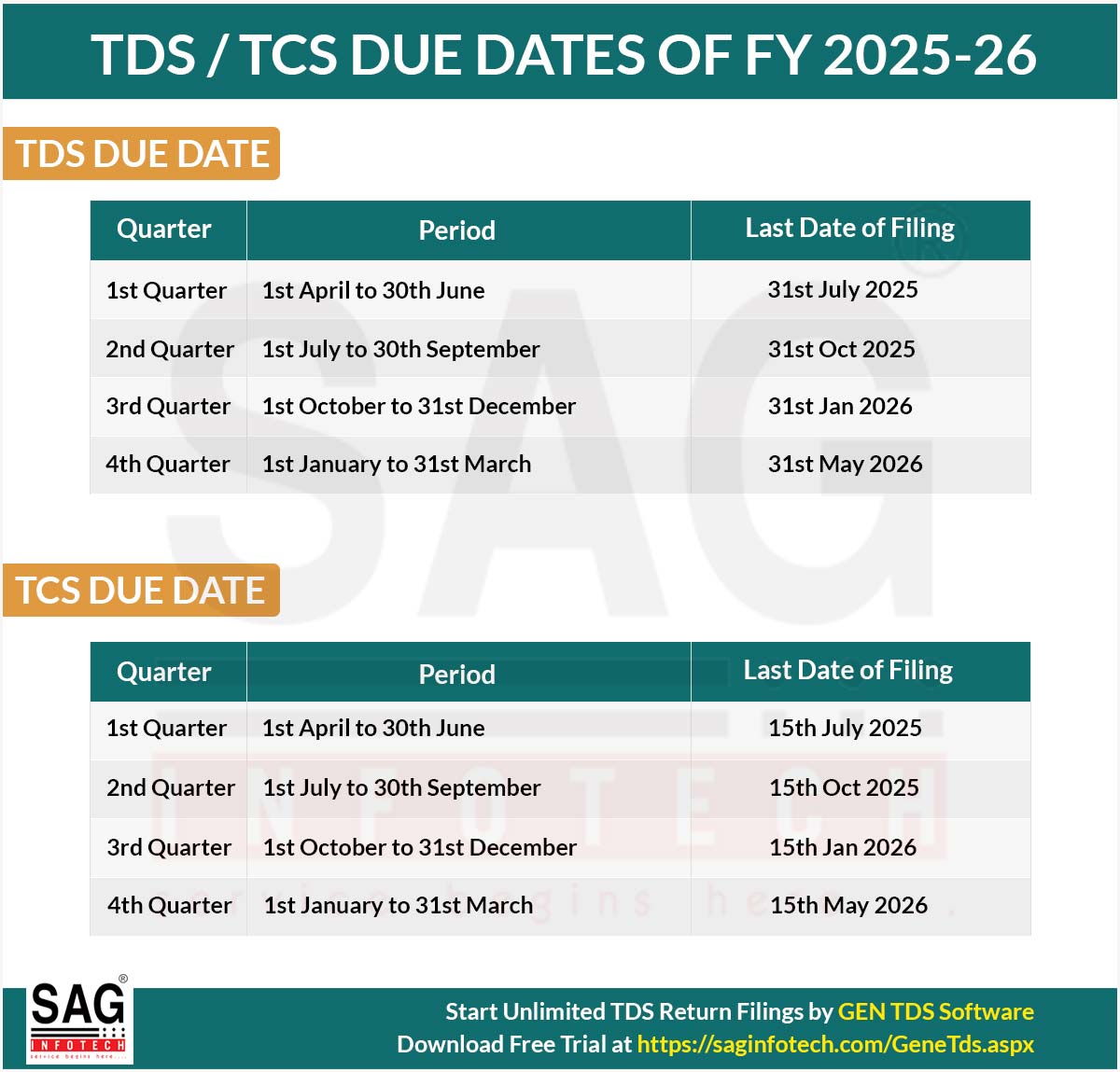

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Due Dates for EFiling of TDS/TCS Return AY 202122 (FY 202021), If you have taken any overseas trip on which tcs has been deducted, then collecting this certificate is important for itr filing purpose.

Source: imagetou.com

Source: imagetou.com

Tcs Filing Due Date For Fy 2022 23 Image to u, According to section 234e, if a person fails to submit the tds/tcs return by the due date specified in this regard, he will be required to pay a fine of rs.200 for each day that the.

Source: corpbiz.io

Source: corpbiz.io

What is TDS Payment Due Date through Challan?, This is the due date for the deposit of tax deducted/collected by an office of the government for march 2024.

Source: financepost.in

Source: financepost.in

Due Date for TDS and TCS Returns FinancePost, Due by 7th april 2024.

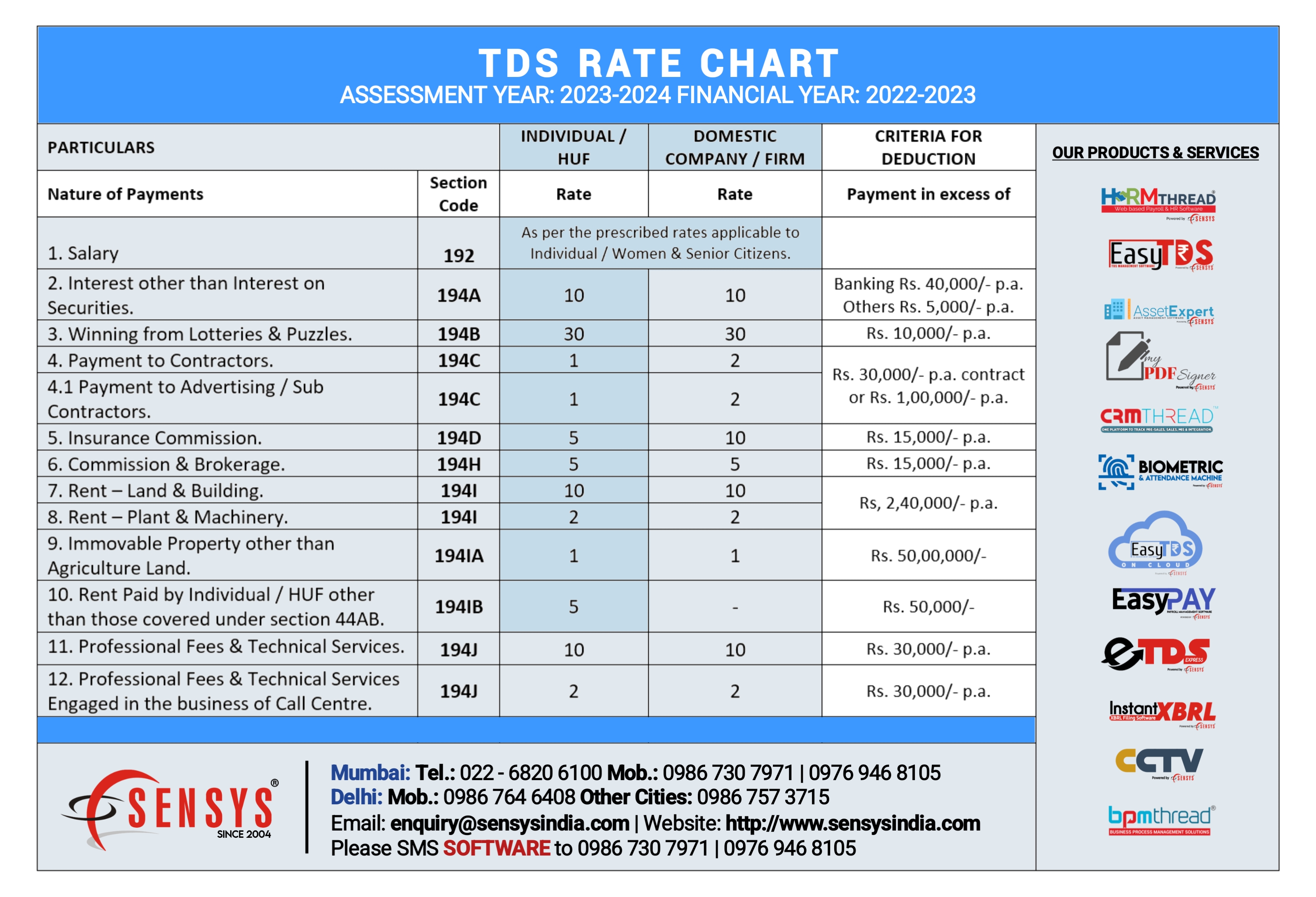

Source: www.sensystechnologies.com

Source: www.sensystechnologies.com

TDS Rate Chart (AY 20232024 FY 20222023) » Sensys Blog., Statutory and tax compliance calendar for the month of february 2024.

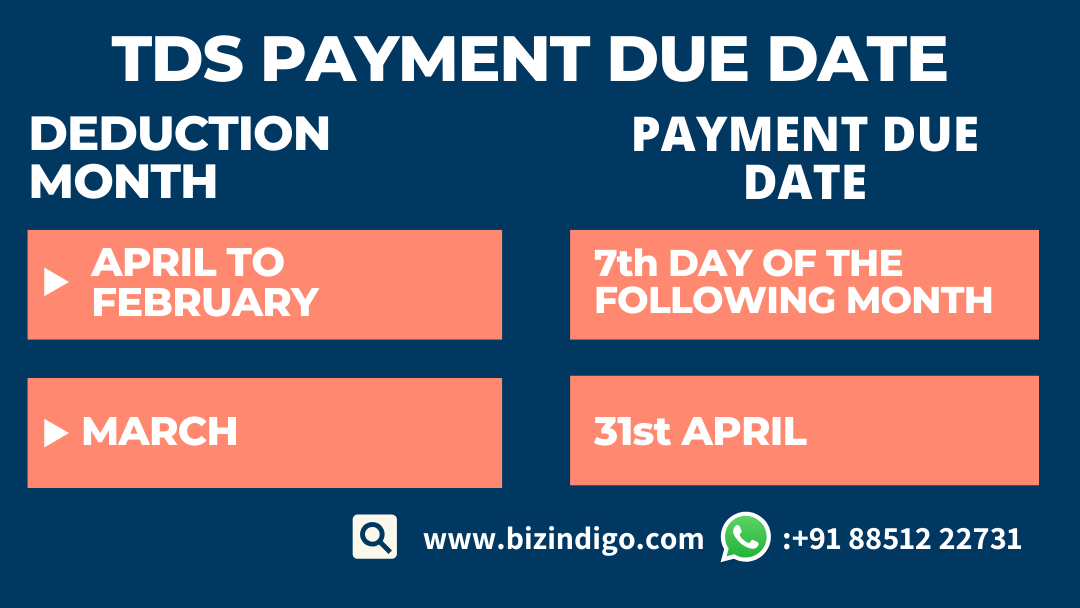

Source: www.bizindigo.com

Source: www.bizindigo.com

Your Guide to TDS Payment Due Dates, Interest (2025) Bizindigo, As the financial year starts on 1st april every year and ends on 31st march next year, let’s have a look at the important dates for taxation purposes and individual taxpayers.

Source: www.youtube.com

Source: www.youtube.com

Due Date TDS &TCS Return Q2 of FY 202223 I Tax I CA Satbir, Avoid penalties by ensuring timely payments and.

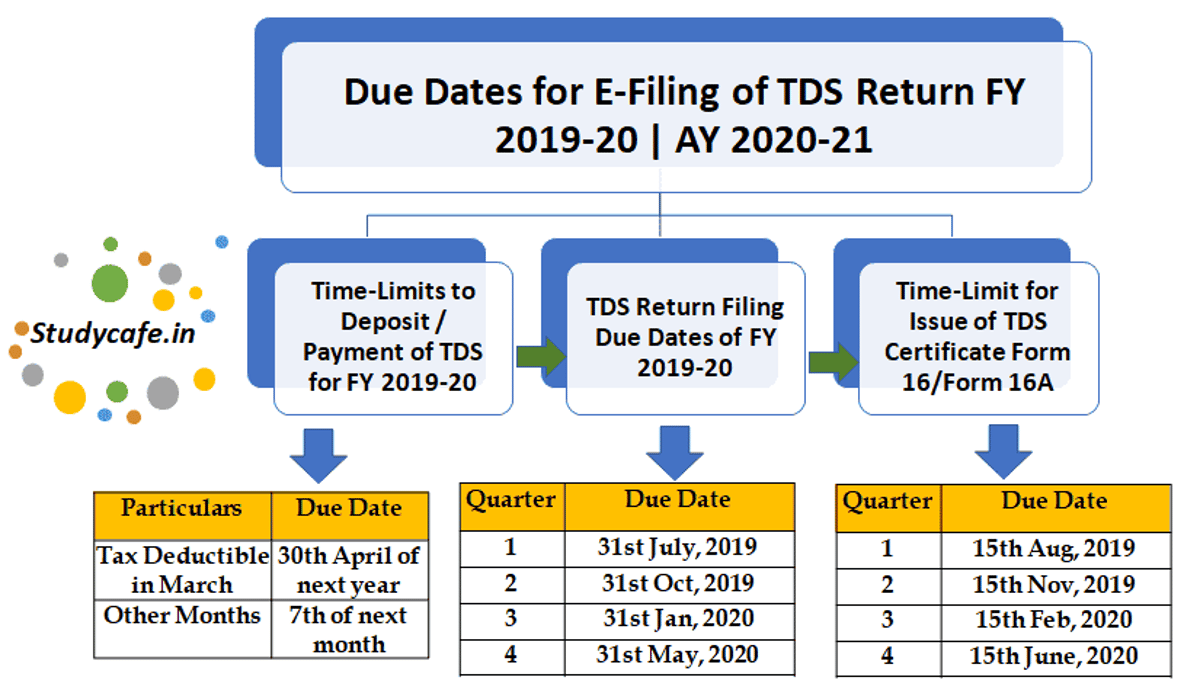

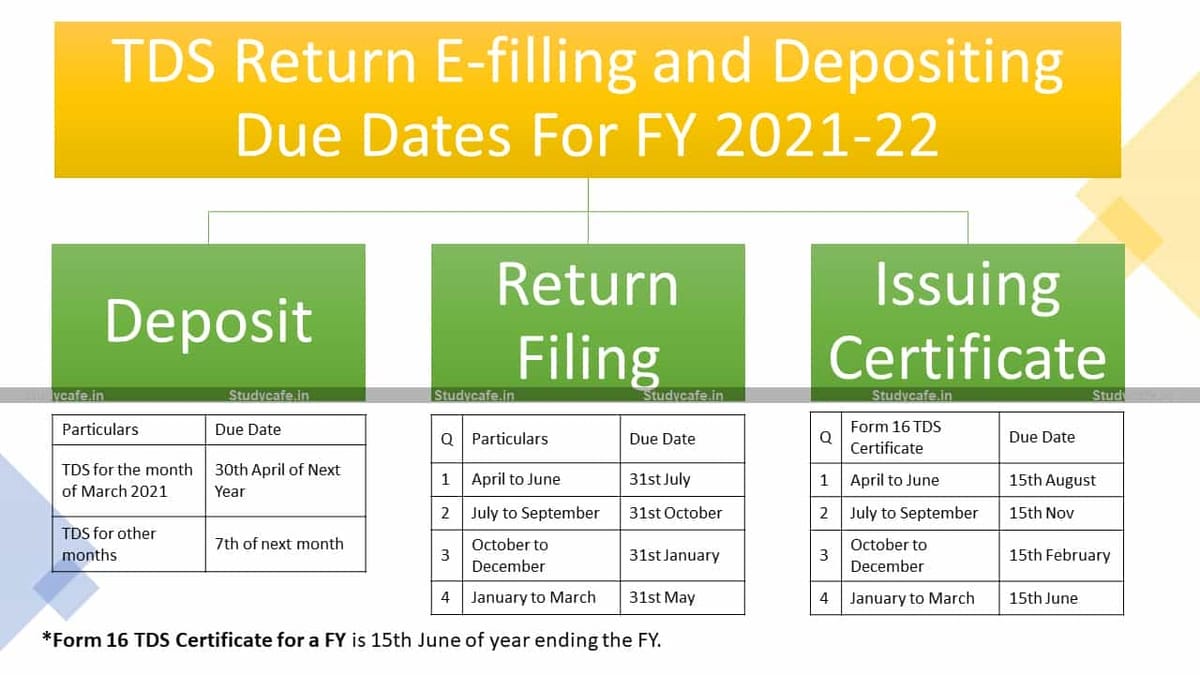

Source: studycafe.in

Source: studycafe.in

TDS/TCS Return Efilling and Depositing Due Dates For FY 202122, However, all sum deducted by an office of the government shall be.

Source: www.gsthelplineindia.com

Source: www.gsthelplineindia.com

eFiling TDS/TCS Return Due Date AY 202021 (FY 201920), Tds tcs payment due date 2024 according to the income tax regulations, it is mandatory for a tax deductor to send the tax deducted at source (tds) by the seventh date.

Posted in 2024